Britain’s biggest banks have told the Prime Minister that the government should make companies such as Meta Platforms, the owner of WhatsApp, shoulder some of the financial burden caused by fraud, Sky News learns.

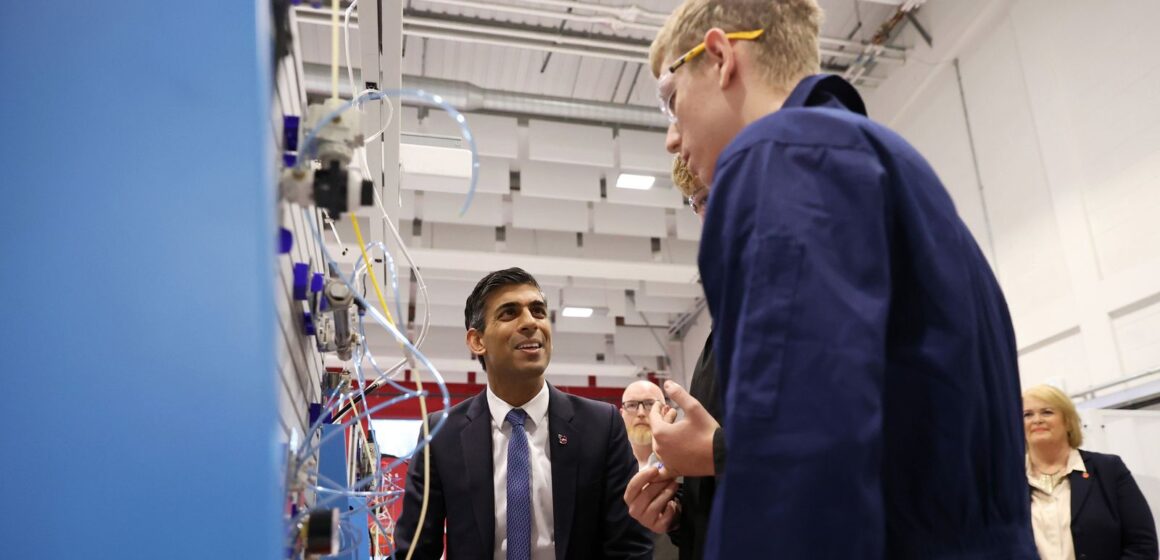

The bosses of Britain’s biggest banks have told Rishi Sunak that technology companies must contribute to the cost of the “pandemic” of online fraud that is undermining international investor confidence in the UK economy.

Sky News received a letter to Prime Minister signed by the CEOs of nine lenders, incl BarclaysNatWest and Nationwide, in which they warned that the UK had become a “global hotspot for fraud and fraud”.

They said that the government National Fraud Strategyunveiled last month, were inadequate to deal with the scale of the crisis, which they say is costing more than £1bn each year to deal with.

Bank bosses have told the Prime Minister that £2,300 was stolen from British consumers every day last year by fraudsters.

And they said they would consider taking further action “to protect our customers” without wider government intervention, including delaying payments, which they described as “a useful but harsh tool that will mean some customers and businesses will find that their legitimate transactions are being held up.”

“Online fraud poses a strategic threat to the UK’s prosperity and impacts on reliability and trust in the economy and financial sector,” the letter, sent on June 6, said.

They want tech companies to be held accountable for stopping fraud at source, to contribute to refunds for victims of fraud originating on their platforms, and for a public record showing the extent of tech giants’ failure to prevent fraud.

The banks’ collective intervention underscores growing frustration that major tech companies such as Meta Platforms, the owner of Facebook, Instagram and WhatsApp, are bearing so little of the financial burden generated by fraud.

The TSB wrote to the New York-listed company this week to demand that it more closely police its social media operations.

TSB chief executive Robin Bullock was among the signatories of the joint letter to the prime minister.

The others were Dame Alison Rose, chief executive of NatWest; Debbie Crosby, CEO of Nationwide; Lloyds Bank Group boss Charlie Nunn; Ian Stewart, Head of HSBC UK; Matt Hammerstein of Barclays UK; Mike Regnier, CEO of Santander UK; Mikael Sorensen of Handelsbanken; and Ann Boden, the outgoing CEO of Starling Bank.

It was also signed by Bob Wigley and David Postings, chairman and chief executive respectively of UK Finance, the banking lobby group.

In it, they called on Mr Sunak to take further steps to tackle the “devastating impact of fraud on people, businesses and the UK economy”.

“Online fraud is a strategic threat to the UK’s prosperity and impacts on reliability and trust in the economy and financial sector,” they said.

“This should not be seen as just a problem for the UK banking sector.

“This has a material impact on how attractive the wider UK financial sector is perceived by domestic investors, which we know is critical to the health of the City of London and the wider UK economy.”

Billions lost to fraud

Executives pointed to a UK financial report which concluded £1.2bn was lost to fraud of all kinds last year and welcomed the appointment of Anthony Brown, a Conservative MP and former head of the British Bankers Association.

They told Mr Sunak that the vast majority of fraud targeting UK consumers “comes from a small number of technology firms, social media firms and telecoms”.

“A fraud strategy that fails to hold all fraudsters accountable and collectively responsible for consumer harm will never be effective.”

“We are not confident that the voluntary measures to be imposed on the technology and telecoms sector will bring about the change needed to reduce the UK’s appeal to fraudsters and prevent harm to customers.”

They complained that the banks’ efforts to tackle the problem were hampered by the Financial Ombudsman Service, which they said placed a disproportionate burden on their industry.

Bosses also said recent talks with government officials had not inspired confidence in Whitehall’s plans to crack down on fraud.

They called on Mr Sunak to make voluntary measures targeting the telecoms and technology sectors mandatory and said they should be forced to educate consumers about security and data risks when making payments.

Technology companies should also be required to provide more visible warnings to customers, bank bosses said.

“One area that we believe requires urgent focus is the prevalence of purchase fraud on META platforms, which is disproportionately higher than its peers,” they said.

“Tech firms, telcos and social media companies must be held accountable for stopping fraud at the source and contributing to refunds when their platforms are used to defraud innocent victims.”

Bank bosses say they have spent more than £500m over the past three years “building defenses that help us stop more than £2bn a year in attempted fraud”.

Among their other demands of Mr. Sunak was that the data be published regularly to name and shame tech companies for the level of fraud originating from their platforms.

“We can all see how these firms collect user data for advertising revenue purposes: this in turn should suggest ways to intervene to protect users from unscrupulous actors,” they said.

Bank bosses also urged the government to be “more ambitious than the 10 per cent reduction (in online fraud) it is aiming for, which will still leave more than two million customers a year suffering.

“With a collective commitment across all pillars, the strategy can be even more ambitious and aim for a more reliable 25 percent reduction in fraud.”