Victoria and Matthew Watts face a large monthly increase in their mortgage payments

More than 400,000 people will see their fixed-line mortgage offers come to an end in the coming months, at a time when lenders are rapidly raising rates and striking deals. How do homeowners manage?

Victoria Watts, who lives with her husband and two children in Norwich, knew her £1,300 a month mortgage was going to increase, but was surprised to learn by how much.

The 35-year-old senior insurance manager received a letter last month saying his fixed-rate contract was coming to an end and the family would need to find an extra £1,400 per month.

Instead they have opted for a tracker mortgage, which will cost them an extra £700 a month, so they can be more flexible in the hope that rates will drop in the future.

Victoria and her husband Matthew work hard to support their children.

Meals out, new clothes and vacations are a thing of the past, she says, and kitchen and bathroom improvements are on hold.

“My husband and I both work and luckily we have savings, but we’re going to have to cut a lot and be very cautious. We just don’t know when things will get better and we may have to consider selling.” our home in the future,” she says.

Lisa Ward has lived in the same house for 25 years and hoped to stay there for many more. But the mother-of-two put her three-bedroom home in Cheshunt, Hertfordshire, up for sale after her mortgage rate rose nearly 300%.

Lisa Ward has to leave Hertfordshire after 25 years due to mortgage costs

The 49-year-old was unable to extend her interest-only mortgage when it recently ended, and offers from other lenders were not within her financial reach.

“I got a letter saying my mortgage was going to go up from £289 to £1,150 a month,” he says. “Now my mum has to sell her house too and we hope to buy a house together in Norfolk because we can’t afford anything in Hertfordshire.

“We don’t want to move there, but we don’t have a choice. I can’t think about the future, but I have to. I have to be positive, pick myself up and get through this.”

He sells his three-bedroom house in which he has lived half his life.

Lisa used to have her own painting and decorating business, but had to stop working due to an intestinal condition, arthritis, and fibromyalgia.

She receives some benefits but they are not enough to cover the huge increase and she feels “very let down by the government”.

Ms. Ward rescued her dog Rexi from Romania and also rescues and rehabilitates hedgehogs and tortoises.

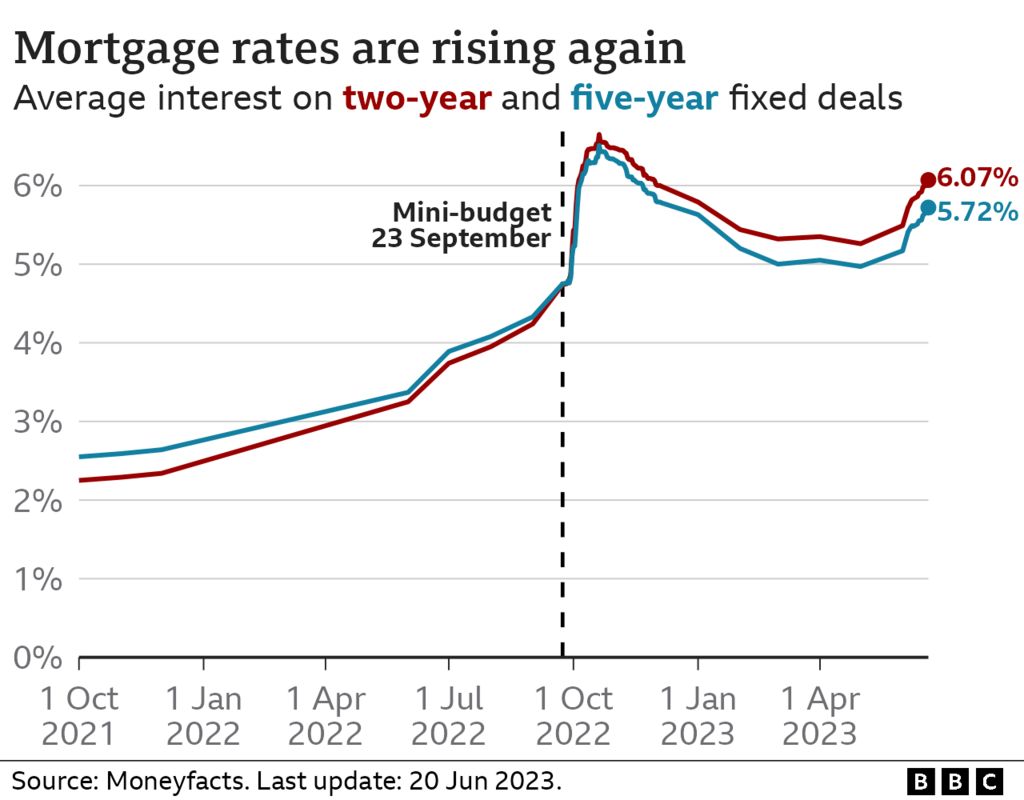

On Monday, the average rate on a two-year fixed-rate mortgage stood at 6.01%, according to the Moneyfacts financial information service.

The Bank of England’s response to rising inflation has been to raise the key UK interest rate, in the belief that people are more likely to save money and less likely to borrow it.

The base rate, currently at 4.5%, will be revised on Thursday and is expected to rise for the 13th time in a row.

Rachelle Gleed, 53, from Bishop’s Stortford, Hertfordshire, describes the situation as “ridiculous, scary and very, very stressful.”

The mother-of-two has a rental property on an interest-only mortgage deal that ends in October and faces a rise of £500 a month to £1,471.

“I can’t pass that increase on to a tenant, I have a lovely family that rents to me and they won’t be able to afford it. I really don’t want to have to sell it, I’d feel really bad for the family, but where am I supposed to find that kind of money? ?”.

Rachelle (left) and her husband Darren (right) have worked their entire lives to support their children Emily and Jake (center) and live comfortably

Rachelle and her husband, who work full-time, are also concerned about their own home mortgage, due to renew early next year.

“I’ve worked since I was 16 and we had gotten to a place where we could live comfortably and have a good vacation, but now I feel like we’ve gone back to caring about every penny,” he says.

Richard, 61, from Cambridge, had to use all his £50,000 savings to cut costs when his fixed-rate mortgage ran out last month.

IT worker Richard has spent £50,000 of savings to try to lower his mortgage rate

The IT worker now has a tracker mortgage, costing £1,000 in fees to switch. His monthly interest payments were due to increase from £260 a month to £803, but he managed to reduce it to £765 using his savings.

“Why does the Bank of England keep raising interest rates?” We got the message to cut our spending months ago.

“The government is concentrating on food and fuel prices. I understand that it hits a lot of people hard. For me, a few cents in the price of a carton of eggs is a drop in the bucket compared to a monthly increase in interest payments. of £500 and everything else to come”.

A government spokesman said it was providing support worth an average of £3,300 per household for this year and next.

“Central banks around the world are raising interest rates in a collective effort to combat high inflation and the Chancellor met with mortgage lenders to make it clear that borrowers must continue to receive support now and in the future.” added the spokesperson.

What happens if I miss a mortgage payment?

- A shortfall equal to two or more months of repayment means you are officially in default

- Then your lender must treat you fairly when considering any requests for changes in the way you pay, perhaps with lower repayments for a short period.

- Any settlement you reach will reflect on your credit file, affecting your ability to borrow money in the future.